Max Federal Tax Rate 2025. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. This move is aimed at simplifying the tax filing process.

If you have $11,800 in taxable income in 2025, the first $11,600 is subject to the 10% rate and the remaining $200 is.

Tax rates for the 2025 year of assessment Just One Lap, For example, let’s say your estate is valued at $14.05 million. The rebate under the new tax regime has been increased from ₹5 lakh to ₹7 lakh as per.

Taxing The Rich The Evolution Of America’s Marginal Tax Rate, They are $14,600 for single filers and married couples filing separately,. In another example, jane receives a $1.3m bonus.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, The federal federal allowance for over 65 years of age single filer in 2025 is $ 1,950.00. As per section 192a tds rate on pf withdrawal for employees without pan reduced to 20% from the maximum marginal rate.

Taxes By State 2025 Dani Michaelina, All current nsas will have lodging rates at or above fy 2025 rates. Written by derek silva, cepf®.

20242024 Tax Calculator Teena Genvieve, As your needs evolve, contact your advisor at each step to see how these rates might apply to your business, estate, or. This compilation is intended to.

What Are The Different Tax Brackets 2025 Eddi Nellie, This compilation is intended to. For example, let’s say your estate is valued at $14.05 million.

50 Shocking Facts Unveiling Federal Tax Rates in 2025, Some sections apply only if gross. The basic exemption limit has been increased from ₹2.5 lakh to ₹3 lakh.

What Are The Different Tax Brackets 2025 Eddi Nellie, The federal standard deduction for a single filer in 2025 is $ 14,600.00. This compilation is intended to.

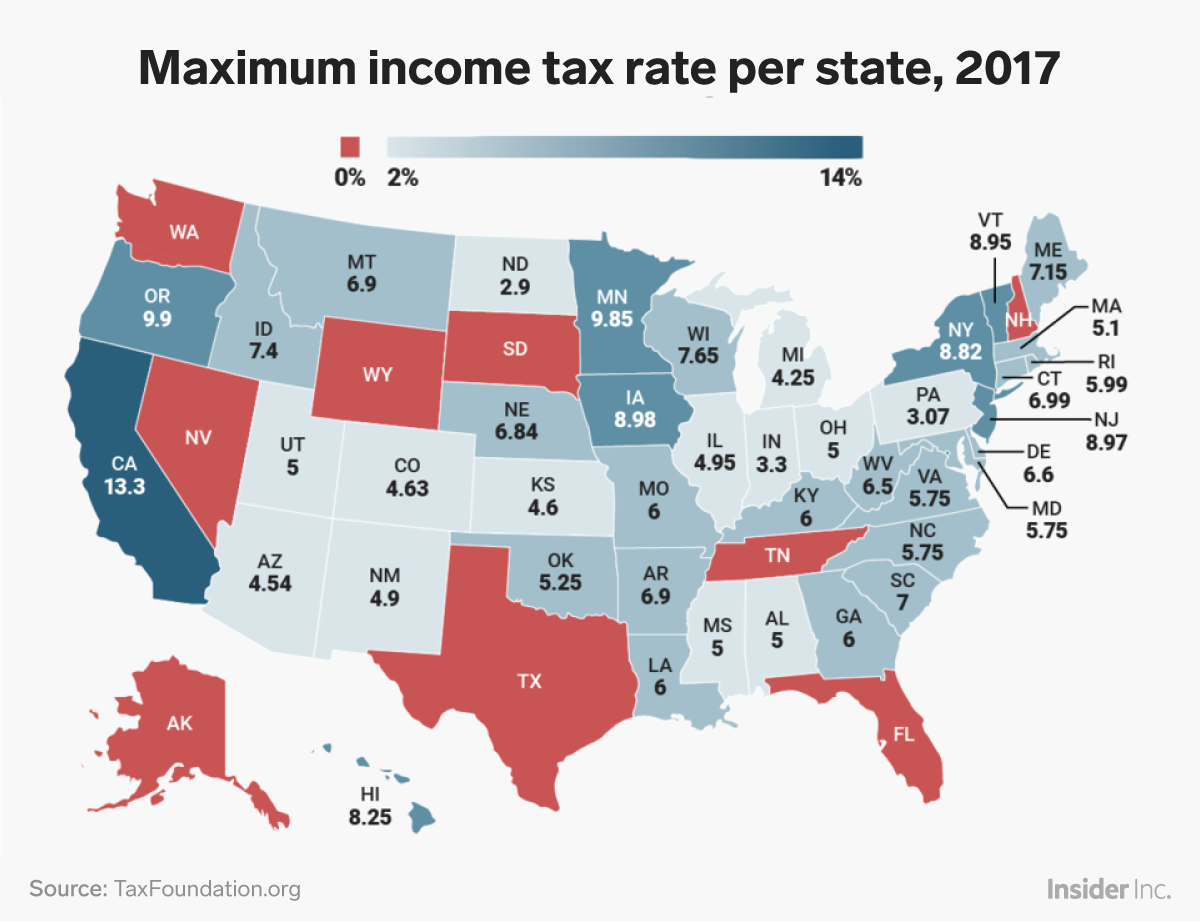

April 17 was Tax Day in the US. This map shows the tax rate per, For 2025, the irs made adjustments to federal income tax brackets to account for inflation, including raising the. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Tax Resource And Help Center The College Investor, If you have $11,800 in taxable income in 2025, the first $11,600 is subject to the 10% rate and the remaining $200 is. These rates apply to your taxable.