Tax Brackets 2025 Married Jointly Calculator. For 2025, the lowest rate of 10% will apply to individuals with taxable income up to $11,600 and joint filers up to $23,200. Calculate your federal, state and local taxes for the current filing year with our free income tax calculator.

You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax. And is based on the tax brackets of.

2025 Tax Brackets Married Filing Jointly Irs Shani Melessa, Simply enter your taxable income and filing status to find your top tax rate. If you want to know your marginal tax bracket for the 2025 tax year, use our calculator.

2025 Married Filing Jointly Brackets Addy Lizzie, For 2025, the lowest rate of 10% will apply to individuals with taxable income up to $11,600 and joint filers up to $23,200. Estimate your potential bill or refund with our free income tax calculator.

2025 Tax Brackets Calculator Married Jointly Ira Heloise, How much australian income tax you should be paying. Simply enter your taxable income and filing status to find your top tax rate.

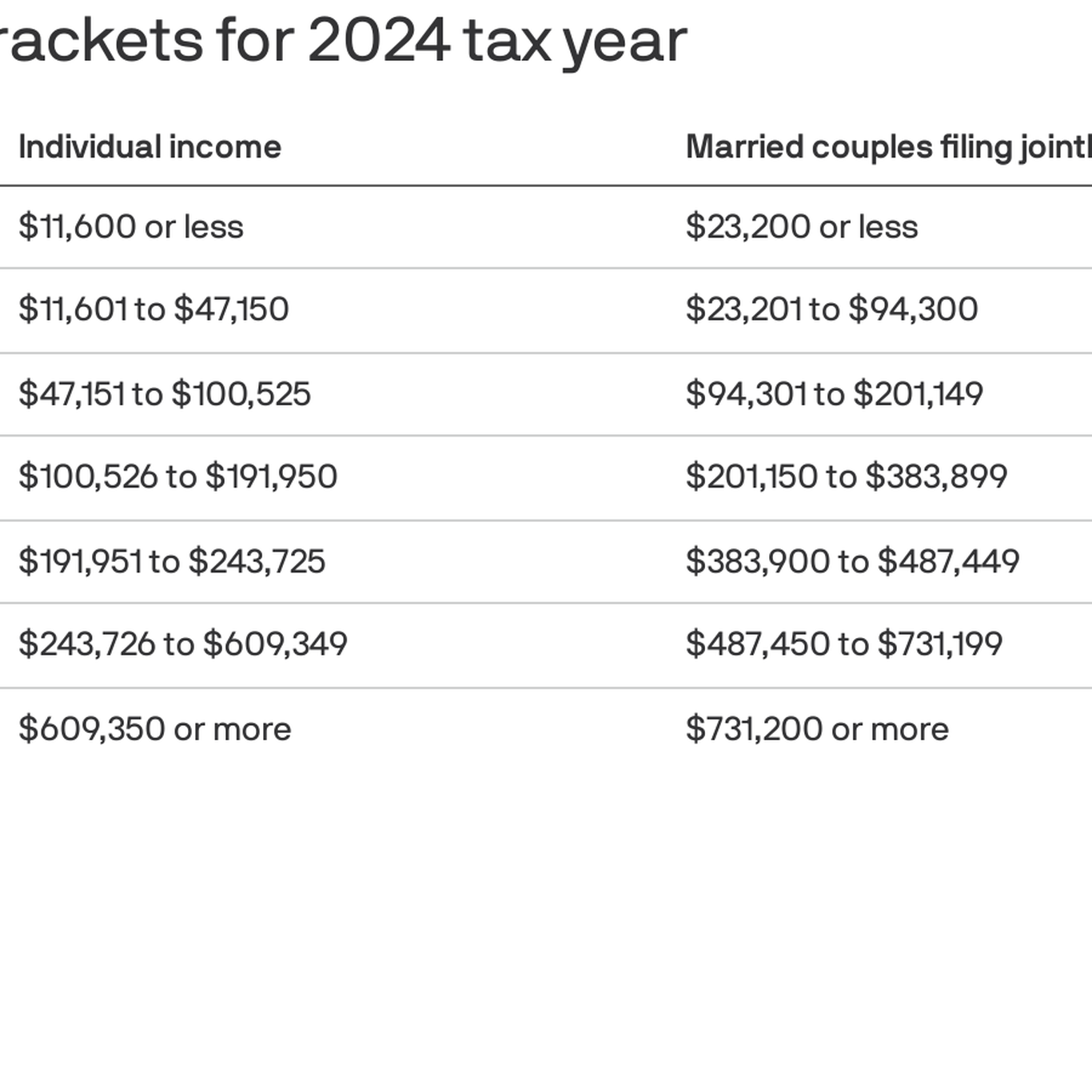

2025 Tax Brackets Married Jointly Gene Peggie, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). Based on your annual taxable income and filing status, your tax bracket determines your.

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, Here are the new tax brackets at a glance: Tax brackets 2025 married jointly calculator get expert insights delivered straight to your inbox.

Tax Brackets 2025 Married Jointly Calculator Daune Laverne, You can estimate your tax cut with the calculator*. Enter your income and location to estimate your tax burden.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, The calculator below can help estimate the financial impact of filing a joint tax return as a married couple (as opposed to filing separately as singles) based on 2025 federal. Your bracket depends on your taxable income and filing status.

California Tax Brackets 2025 2025 Married Maxie Rebeca, Enter your income and location to estimate your tax burden. Also calculates your low income tax offset, help, sapto, and medicare levy.

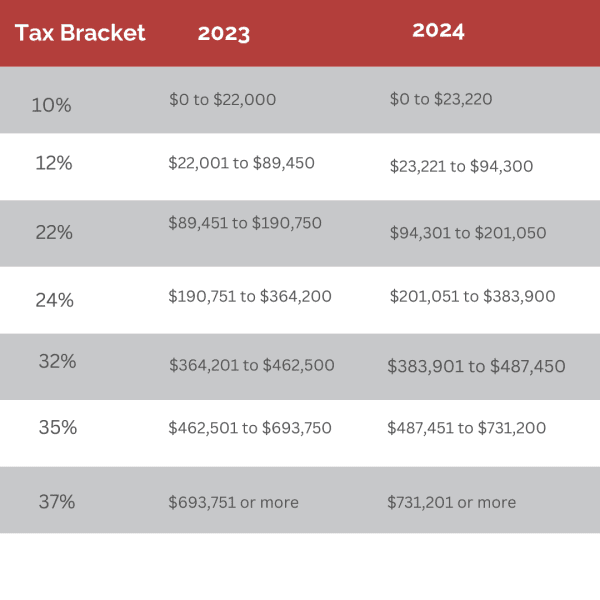

Tax Bracket Changes 2025 For Single, Household, Married Filling, You can estimate your tax cut with the calculator*. The seven federal income tax brackets for 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

2025 Irs Tax Brackets Married Filing Jointly Helen Kristen, Gross tax is the tax on taxable income before tax offsets are taken into. And is based on the tax brackets of.

For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).